Despite the constant advances that are being developed in the world of telecommunications, fraud continues to be a risk for companies, a reason why they lose 5% of their income each year, according to data from the Report to the Nations of the Association of Certified Fraud Examiners (ACFE). In this scenario, with the emergence of the pandemic, biometrics to improve the customer experience has become an option chosen by a large part of the population, thanks to the trust it brings to users.

61% of people are more secure using this type of technology as an authentication method to access their accounts than before the arrival of COVID-19. This data is not only reflected in this area, but trust in digital tools has also spread to other fields. One in two people also relies more on digital channels to access services such as banking, online purchases and procedures related to public administrations.

These are some of the conclusions of a study carried out. It has collected consumers’ opinions from different countries to analyze how the pandemic has revolutionized the digital experience. Respondents still prefer to communicate with brands in person (33%) or with a physical agent over the phone (24%), and channels such as email (18%) or the virtual telephone assistant (6%) are starting to gain. Terrain, due to its speed and comfort.

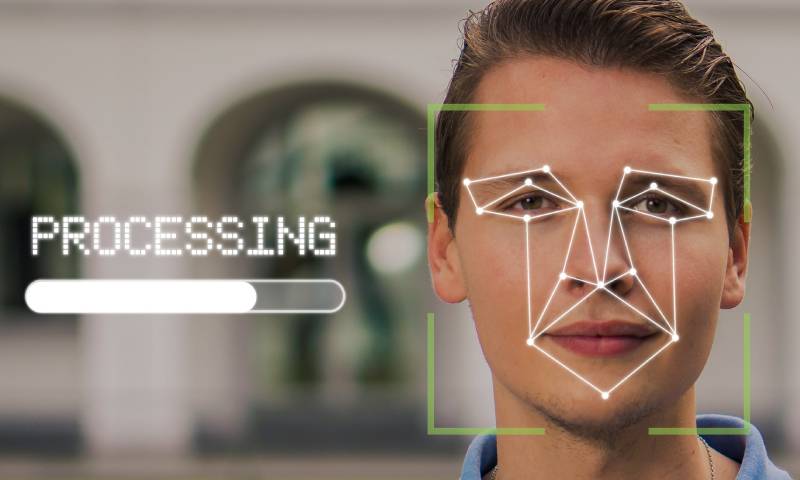

Creating new ways of interacting with consumers, which require the least possible effort, is also a window for cybercriminals trying to discover potential vulnerabilities in the operator’s customer service infrastructure. In this context, biometrics stands as a new mechanism to authenticate people and prevent fraud in companies with which it is possible to create higher quality experiences.

New Formulas To Increase Safety

On the other hand, as detailed in the study, some solutions based on this technology are facial or fingerprint, voice and behaviour. The first one uses your face or fingers to access the device. Its use to start sessions or start using mobile applications is practical.

However, they don’t offer enough security when it comes to carrying out “higher risk” interactions. The second category, voice biometrics, verifies the identity and identifies criminals by comparing incoming voice audio to a database of stored voiceprints “from both legitimate customers and recognized repeat scammers.”

Behavioural biometrics is a mechanism that works in the background and detects fraud based on how people interact with your device. Thus, it analyzes the typing speed, when the keys are pressed, the pauses and how you use the mouse or slide on the screen.

Also Read: Types of Posts on Twitter Which One is Right For You?